Categories

- All Categories

- Oracle Analytics and AI Learning Hub

- 43 Oracle Analytics and AI Sharing Center

- 19 Oracle Analytics and AI Lounge

- 283 Oracle Analytics and AI News

- 60 Oracle Analytics and AI Videos

- 16.3K Oracle Analytics and AI Forums

- 6.4K Oracle Analytics and AI Labs

- Oracle Analytics and AI User Groups

- 108 Oracle Analytics and AI Trainings

- 20 Oracle Analytics and AI Challenge

- Find Partners

- For Partners

Regarding Financial Category (Other Operating Expenses vs. Misc. Operating Expenses)

This is related to Chart of Accounts (COA) mapping question. Lack of clear and detail descriptions/samples it is very difficult to map accounts to OOTB Financial categories to Natural accounts.

e.g. Other Operating Expenses vs. Misc. Operating Expenses. There are two categories that are so similar in definition and usage. Seeking some real sample scenarios from this communities on how these categories used and what's make them different?

Best Answer

-

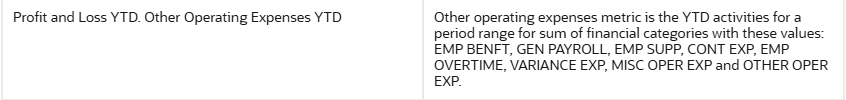

You're right, these are very similar categories! As I think you implied from your question, there isn't much OOTB impact by having separate financial categories because they're both referenced in these two metrics, and are only calculated separately when referring to themselves:

I think mileage can vary depending on the customer, but here's my personal take on why it may be nice to break these two categories out:

Other Operating Expenses Financial Category:

Because operating expenses can differ depending on what a company does, the various other OOTB Financial Categories provided in Fusion Data Intelligence may not capture all of the Operating Expenses that apply to a particular company. That's where customers can group all of those remaining natural accounts to the "Other Operating Expenses" financial category.

Miscellaneous Operating Expenses Financial Category:

Now let's say that a company has a natural account called something along the lines of "Miscellaneous Operating Expenses" to pick up any one-off operating expenses that they don't have an existing natural account for because they happen so infrequently.

But perhaps as an analyst, you want to be able to quickly analyze if expenses in this category are growing over time or abnormally (Example analyses: Are expenses being booked here miscategorized? or: Should the company consider creating a new natural account if balances in this account are from similar suppliers?)

If the company assigns this natural account to the "Miscellaneous Operating Expenses" financial category, the analyst will be able to easily keep an eye on this through a simple drag-and-drop of the metric.

1

Answers

-

Jamie, thanks for the detail explanation. In summary, for any "one-off" or "infrequent" expenses to use MISC category. More predictable expenses can use OTHER category.

thanks again for the details.

1