Best Of

Re: Closing (losing) an opportunity

Hi all,

This is why it was confusing, because it WAS changing the status from a Lead to Prospect when I was creating an opportunity, so I assumed it would change a Customer back to a Prospect if I lost the opportunity.

Tested and confirmed.

Confusing, but we got there in the end.

Thank you for all your help!

Re: Upload mid-life assets with Japan 200% Declining Balance

Re: How to add a NOTES field to a Saved Search setup screen

Thank you Patrick. As usual, you are able to find the SuiteIdea that I cannot.

That enhancement is just what I was asking for but was unable to find.

It sure would be fun to sit in with the decision makers who have ignored this enhancement for 10 years and try to understand their reasoning. The fix seems so simple and would help so many in small & big organizations.

Thank you again.

Re: Rest APIs - Please clarify if available for Custom Records and custom fields

Amazing! Thank you, Nicole Mendoza!

Re: Credit Card to pay employee expense reports

Hello there.

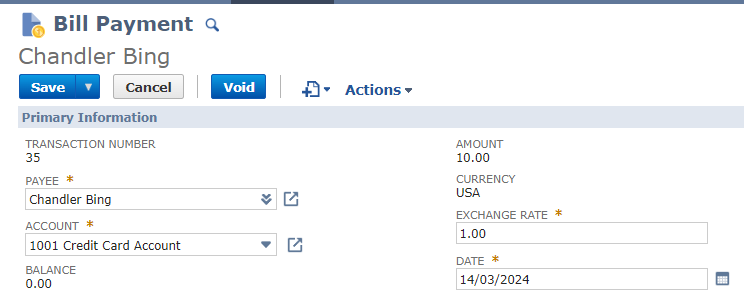

You can choose the Credit Card account on the Bill Payment record.

Re: Unable to reopen closed Sales order

Hi @User_USGXE ,

Yes it is possible to reopen the Closed Sales order

This seems more like a network issue , or please check any Workflow or Scripts triggering when changing the status of the sales order

Re: Item Demand Plan CSV import Error

Hello @Elychelle Gulen-Oracle

Thank you for help. It turns out you cannot directly edit the csv file with dates (as the format gets reset to m/d/yyyy.

After few troubleshooting, figured out that all data needs to be created in Excel with correct date formatting. Once done, save the final file to .csv for import.

Issue resolved !!

Re: Set up a 100% non deductible input VAT in France

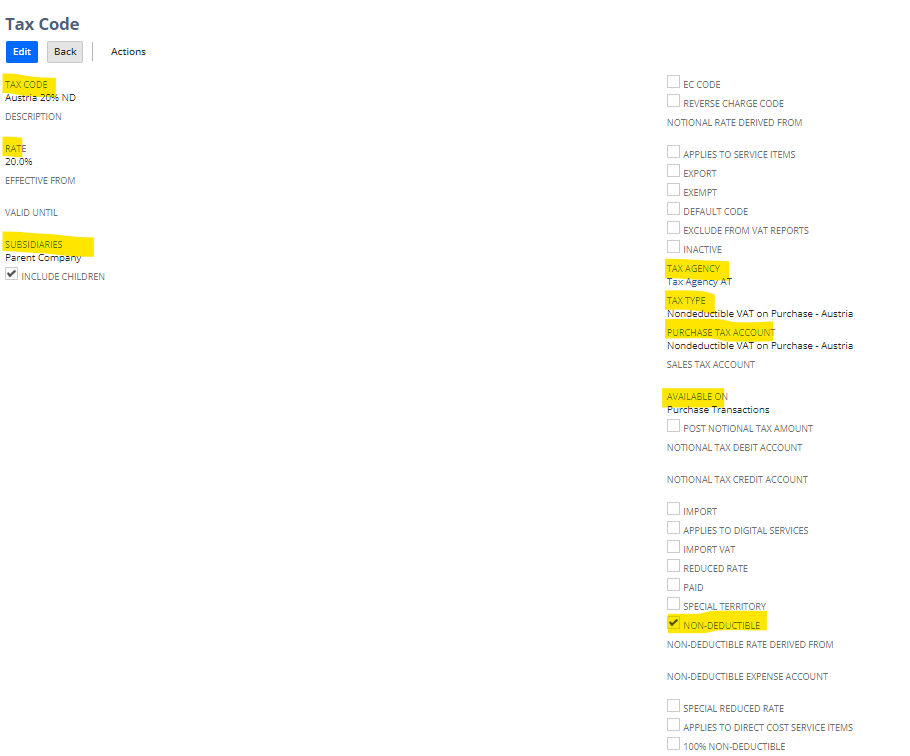

Hi @Yasmine BELAOUCH, from SuiteAnswer: 24324 were you able to create both of these?

- To create a nondeductible portion of the VAT

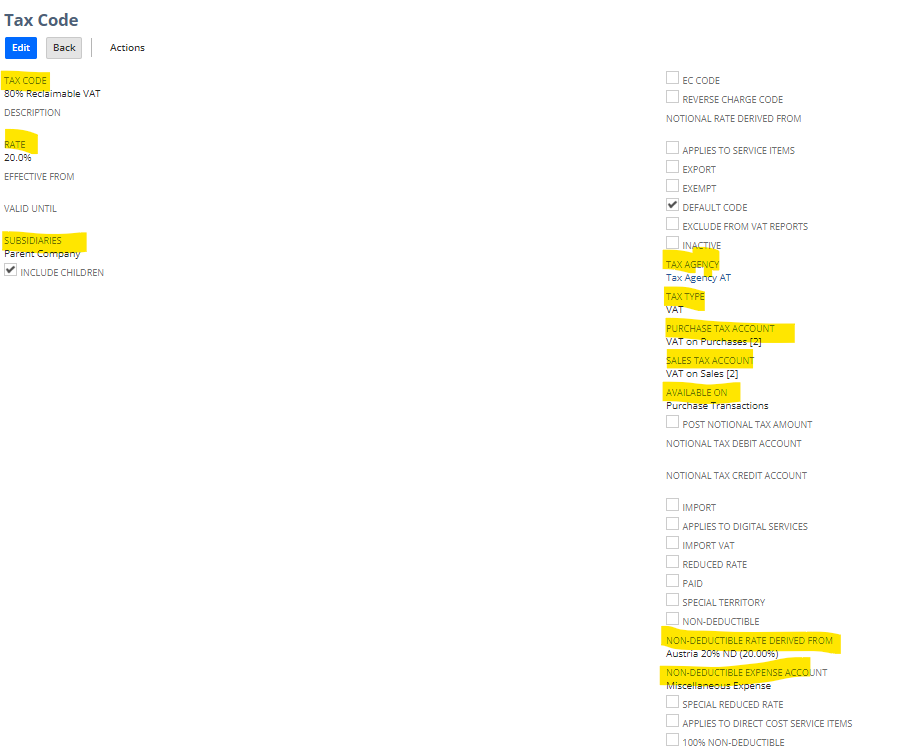

- Creating a Tax Code for the Reclaimable Portion of the VAT

As per SAID 30566, To apply nondeductible tax on a transaction:

Add items or expenses with nondeductible tax by using a tax code that represents the reclaimable portion of the VAT.

Here are the nondeductible and reclaimable portion of the VAT i created for testing purposes:

Nondeductible:

Reclaimable VAT:

- In the Nondeductible Rate Derived From field, select the tax code that represents the nondeductible portion. For example, in the previous procedure, the tax code for the nondeductible portion of the VAT is called Austria 20% ND.

- In the Nondeductible Expense Account field, select the expense account that the nondeductible tax should be posted to, for example Miscellaneous Expense. The selected expense account is the default value for the expense account column on the transaction.

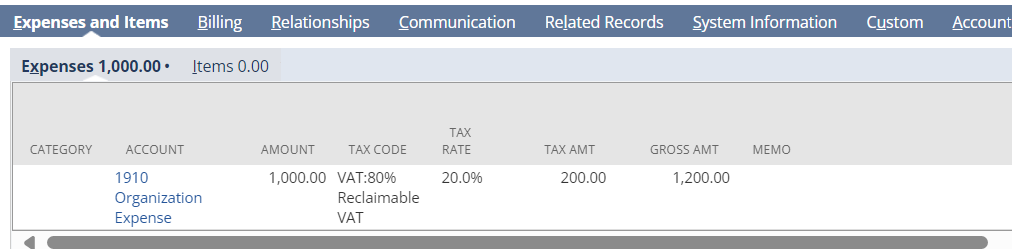

Here's a transaction I created:

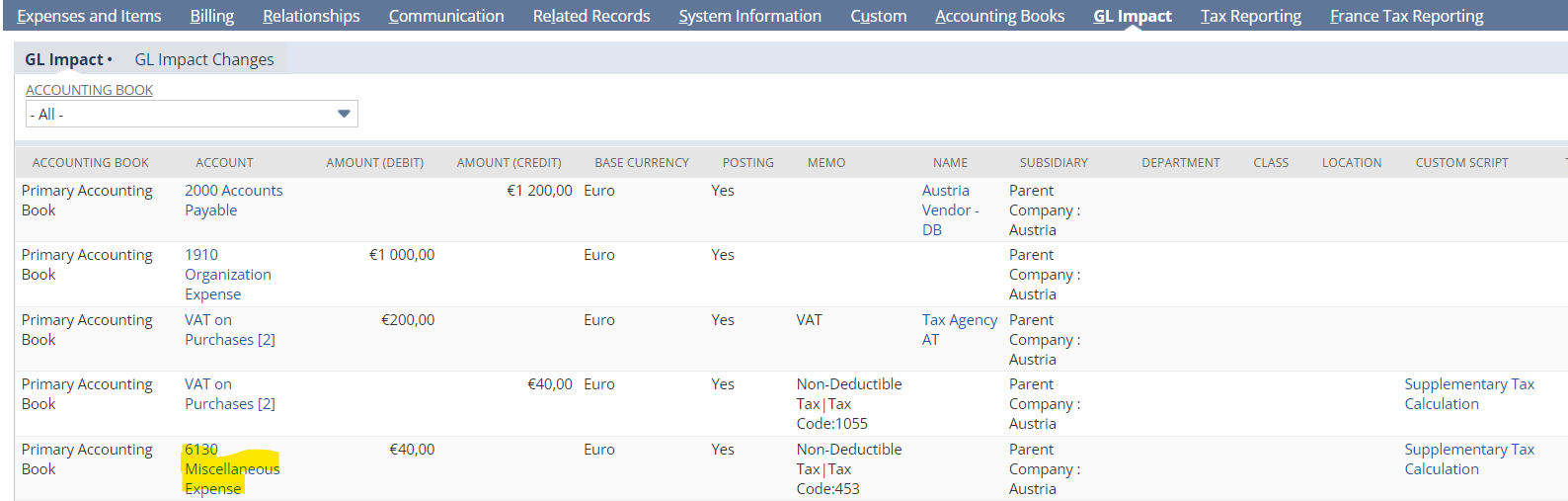

Here's the GL Impact:

As you can see the nondeductible portion of the VAT is now posted on the Miscellaneous expense account.

Hope this helps! :)

Re: Reports for emails and messages

Hey @tech work,

If you build a "Sent Email" Saved Search, it would show all messages sent to/from NetSuite.

Are you also sending Text Messages from NetSuite? If yes, are you using a third-party solution for that?

Re: How to get value customform field in Advanced PDF/HTML templates?

Yes, this workaround of setting a custom field to hold the Custom Form value using a Workflow is working for me.