Best Of

Re: Best way to hide old transaction in match bank data page

I would recommend that you take an actual bank statement from the month BEFORE you want to begin the reconciliations. Using that statement, enter your ending bank balance with the date, and clear EVERYTHING except uncleared checks for that account. This will clean up the 'historical' data and clear it out of your way to begin matching the bank data with a clean set of transactions, and you'll be ready to go.

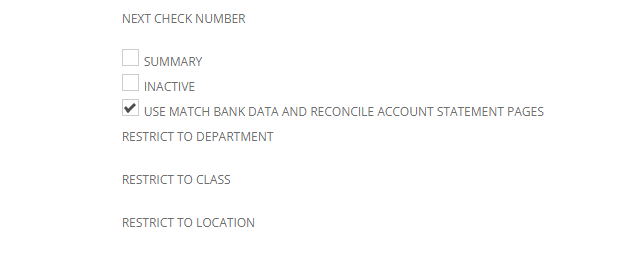

(If it were me, I would uncheck the USE MATCH BANK DATA AND RECONCILE ACCOUNT STATEMENT PAGES - then navigate to transactions, bank, reconcile bank statement. While this process is deprecated, it allows you to clear the transactions MUCH FASTER! Once it's reconciled with ending date & balance, and you can go back into the account and check the USE MATCH BANK DATA AND RECONCILE ACCOUNT STATEMENT PAGES box again. I've done this hundreds of times for go lives (clearing historical balance entries, and using the old bank reconciliation page works cleaner and with less effort than matching the transactions.)

Good Luck!

~angela

Re: ReferenceError: "value" is not defined. (INVOCATION_WRAPPER#3)

Thanks Micah, the original ticket was opened in 2021 and there still hasn't been any progress. Unluckily processing charges manually is not a good alternative solution as the idea is to use the match bank data module to save time in processing. Can you provide an estimated date to solve the limitation?

I believe the issues is that we are transacting in a VAT country and the module seems to pull the tax code from the default tax defined in the Set up Taxes for each Nexus.

I am able to process it with the same role as the end users but they do not, the only difference between them and me is that I have an admin role within my user, so my guess is that this is probably a permission issue? Maybe they cannot access the defaulted tax code.

Tax code is mandatory in the Check Form when transacting in a VAT country.

Re: Filter Inventory Snapshot

Yes, I tried using that, but it didn't give me any of the information I needed.

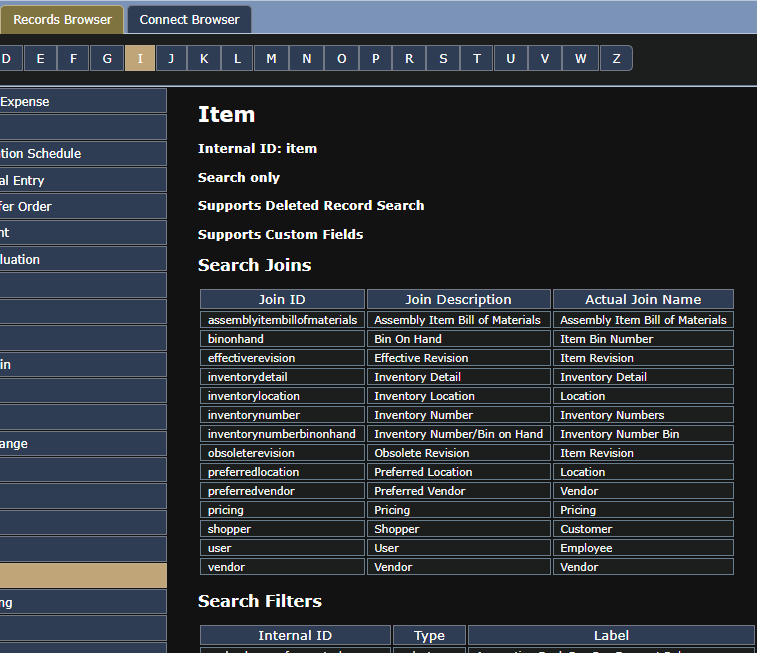

I used the help center info. What was confusing was that on the Item file page, salesdescription is listed as a Search Filter. Here is a screen shot, since this forum apparently doesn't allow users to post web addresses:

Thanks!

Re: Oauth v2.0 client credentials flow getting invalid_grant

Sorry for the delay. I tried to repro it today and could not get the invalid_grant error again. Everything seemed to be working fine. On my debug machine, and postman on the same machine.

Really odd. Hence why I'm thinking it must be some rate limiting on Netsuite's side that limits how often you can try to ask for the access token on the same app. When I'm debug testing the app, it doesn't reuse the access token and always asks for a new one.

If I encounter this again, I'll make sure to capture the output on fiddler and post it here.

Re: Subsidiary Merge

At some point, you will need to migrate the trial balance from the old subsidiary, and at that point, you'll need to ensure that all inventory is moved to the new subsidiary at the same time. This will truly 'migrate' all data off of the old subsidiary, and allow you to inactivate it.

~angela

Re: Supplier ID Character Limit

Thanks for your help! Disappointed to find the solution for this isn't available but I did "upvote" the enhancement request as this would be very helpful to me and my team.

Thanks again for the information!

CPAGrrrl

CPAGrrrl

Re: Subsidiary Merge

Thank you @Angela Bayliss

Gradually, we are phasing out transactions with the old subsidiary and plan to deactivate it by the end of the current month. I have completed all necessary steps except for merging customers and vendors. To ensure inventory availability across all subsidiaries, I have enabled the inclusion of children.

Following the entity merge, we will initiate new transactions using the primary subsidiary and address any pending transactions associated with the old subsidiary. Subsequently, we will transfer the balances from the old subsidiaries to the primary accounts after closing all pending transactions. I just want to confirm the feasibility of this approach.

I really appreciate your help!

Re: Display tax amount and grossa amount on item receipt

Greetings, everyone! We have a fellow member, @GiCo74 , who could use our assistance. Please don't hesitate to share your knowledge and best practices to help them out. Your input is highly valued and appreciated!